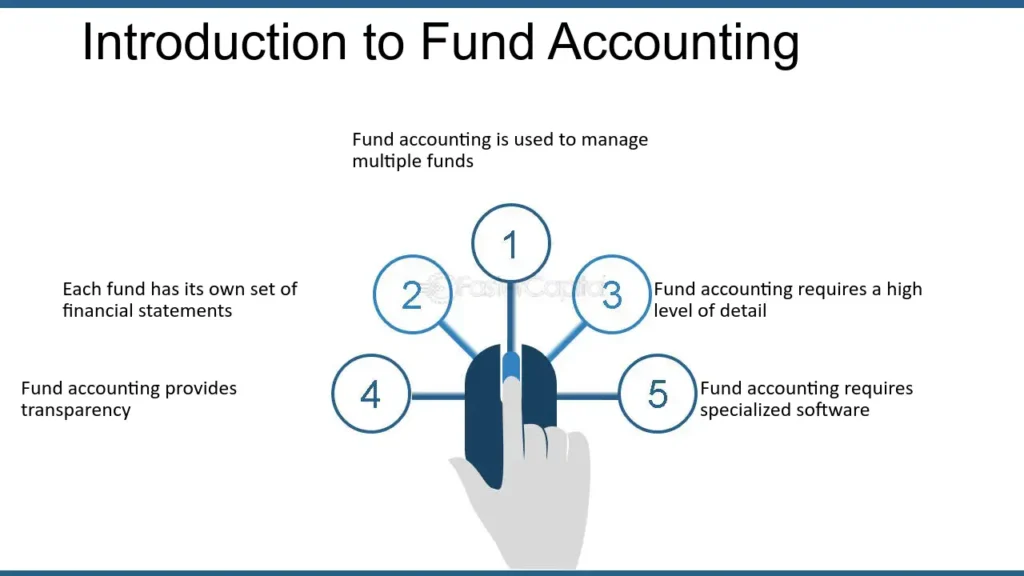

1. Introduction

Fund Financial Statements Consolidation; Fund accounting represents a distinct methodology that prioritizes accountability and transparency, particularly within not-for-profit entities such as charities, governmental organizations, and educational institutions. In contrast to conventional business accounting, which centres on profitability and evaluates financial performance through income and expenditures, fund accounting is structured to ensure that resources are allocated strictly in accordance with the intentions of donors, the stipulations of grants, or regulatory mandates. Fundamentally, fund accounting is based on the principle of categorizing financial resources into separate “funds,” each designated for a specific objective. This categorization enables organizations to monitor income, expenditures, and balances for each fund independently, thereby preventing any misallocation of resources.

For example, a non-profit may maintain distinct funds for general operations, a construction initiative, and a scholarship program. By preserving these separations, fund accounting offers a transparent view of resource management and guarantees adherence to donor and legal requirements. The significance of fund accounting lies in its capacity to foster trust between an organization and its stakeholders, including donors, grantors, and regulatory authorities. By emphasizing accountability rather than profitability, this framework allows organizations to exhibit fiscal prudence, effectively fulfil their missions, and ensure long-term viability in their community service efforts.https://finanacialconsultancy.com/

2. Key Features of Fund Accounting

Resource Allocation

A fundamental aspect of fund accounting is the allocation of resources into separate funds. Each fund is assigned a specific purpose or goal, ensuring that the resources designated for a particular fund are used solely for that intended purpose. For instance, a non-profit organization may establish a disaster relief fund that is exclusively allocated for emergency assistance initiatives. This method of resource allocation allows organizations to manage various revenue sources with differing restrictions effectively, thereby preventing the misappropriation of funds. The segregation of resources is essential for promoting transparency and accountability, as it allows stakeholders to monitor the flow of resources and verify adherence to funding agreements.

Classification of Funds

In the realm of fund accounting, resources are classified into various types of funds according to their intended use and the restrictions attached to them. The three main classifications are restricted, unrestricted, and designated funds:

- Restricted Funds: These funds are bound by specific limitations set by donors, grantors, or other external entities. For example, a grant may stipulate that funds be allocated exclusively for a healthcare initiative or educational scholarships. Restricted funds ensure compliance with donor stipulations and legal requirements.

- Unrestricted Funds: In contrast to restricted funds, these funds are not subject to external limitations and can be used for the organization’s general operations. Examples include general donations and membership fees, which provide greater flexibility in addressing the organization’s operational needs.

- Designated Funds: These are unrestricted funds that have been internally allocated by the organization for particular purposes. For instance, a non-profit may designate a portion of its general funds for an upcoming capital project. Although not externally restricted, these funds reflect the strategic priorities of the organization.

Emphasis on Compliance

Compliance serves as a fundamental principle in fund accounting, with systems established to meet legal, regulatory, and donor-specific requirements. This necessitates the utilization of funds strictly in accordance with the stipulations set forth by funding sources, ensuring that the organization remains answerable to all stakeholders. Achieving compliance demands thorough record-keeping, comprehensive financial reporting, and transparent audit trails to confirm that funds have been utilized appropriately. For example, a government grant allocated for infrastructure projects must be distinctly accounted for and accompanied by supporting documentation to validate adherence to grant conditions. By placing a strong emphasis on compliance, organizations can cultivate trust among stakeholders and sustain their eligibility for future funding opportunities.

Focus on Accountability

Fund accounting systems emphasize accountability rather than profitability, distinguishing them from conventional accounting practices. Organizations must illustrate how funds are distributed and utilized, allowing stakeholders—including donors, grantors, and regulatory agencies—to assess the effectiveness of financial management. Comprehensive financial reports and statements provide stakeholders with insights into whether resources are being deployed in accordance with organizational objectives and funding requirements. This focus on accountability not only enhances trust but also bolsters the organization’s reputation and credibility. For instance, a charity that clearly demonstrates the allocation of disaster relief funds is more likely to maintain donor support and attract new contributions.

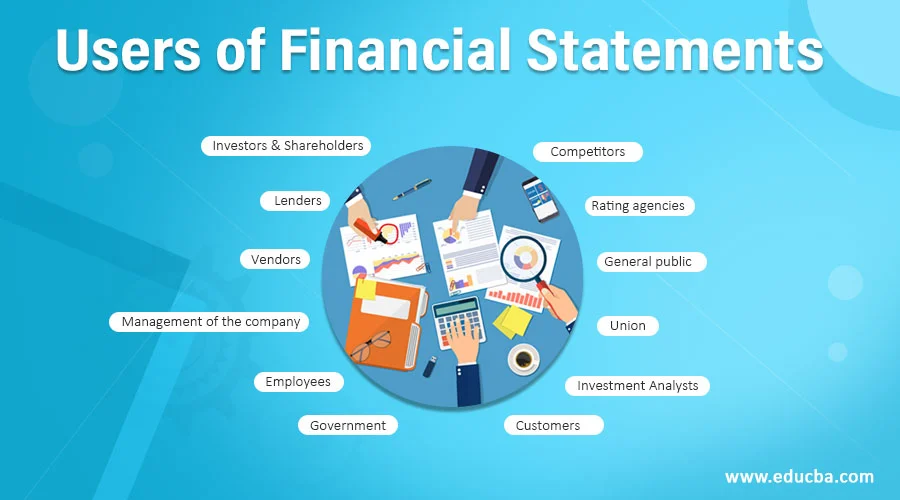

3. Who Uses Fund Accounting in the United States?

Fund Financial Statements Consolidation; Fund accounting is extensively employed in the United States by entities that oversee various revenue streams with distinct restrictions. The main users of fund accounting include:

Fund Accounting in Government Entities

Fund Financial Statements Consolidation; Government entities, encompassing federal, state, and local organizations, are among the foremost users of fund accounting. These bodies manage public funds, primarily sourced from taxpayer contributions. To guarantee the appropriate allocation and utilization of these resources, fund accounting categorizes financial activities into different segments or “funds.” For instance, general funds are designated for operational costs such as salaries and utilities, capital project funds are reserved for infrastructure developments like roads and bridges, and special revenue funds are allocated for specific initiatives such as healthcare or education. This methodology promotes transparency and adherence to legal and regulatory standards, thereby fostering public trust. By meticulously tracking the flow and application of taxpayer funds, fund accounting empowers government entities to produce accountability reports for the public, legislators, and oversight organizations. In the absence of this system, it would be challenging to ascertain whether funds are being utilized as intended or to identify potential misappropriation of public resources.

Fund Accounting in Non-profit Organizations

Non-profit organizations, including charities, religious groups, and NGOs, significantly depend on fund accounting to manage their varied funding sources. These organizations frequently receive donations, grants, and contributions that come with specific restrictions imposed by donors. For example, a donor may allocate funds specifically for disaster relief, educational programs, or healthcare initiatives. Fund accounting ensures that these restricted funds are separated and used exclusively for their designated purposes. Through this accounting method, non-profits can monitor their financial activities across multiple projects and demonstrate compliance with donor stipulations.

Fund Accounting in Educational Institutions

Educational institutions, such as schools, colleges, and universities, represent a significant demographic that utilizes fund accounting. These entities frequently navigate intricate funding frameworks that encompass grants, scholarships, endowments, and various restricted revenue sources. For instance, a university may obtain an endowment specifically earmarked for student scholarships or a research grant designated for particular scientific inquiries. Fund accounting enables these institutions to ensure that funds are utilized and allocated in accordance with the stipulations set forth by donors or grant agreements. By establishing distinct accounts for each category of fund, educational institutions can deliver precise financial reports to their stakeholders, which include donors, grantors, and governing boards. This degree of accountability is essential for preserving their reputation and attracting future funding. Additionally, fund accounting fosters transparency in the management of both public and private funds, thereby enhancing trust among students, parents, and the broader community.

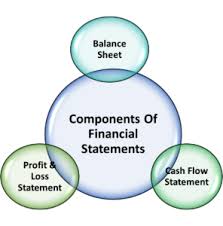

4. Components of Combining Fund Financial Statements

Balance Sheet

The balance sheet serves as a crucial element of combining fund financial statements, offering a comprehensive overview of an organization’s financial status at a particular moment. It details the assets, liabilities, and fund balances for each distinct fund, along with a total consolidation for all funds. This segmentation enables stakeholders to evaluate the financial condition of individual funds while gaining insight into the organization’s overall financial standing. For instance, a nonprofit may delineate separate balances for its general fund, restricted fund, and endowment fund, illustrating the allocation of resources and the management of liabilities within each category. By providing a clear and transparent depiction of financial resources, the balance sheet plays a vital role in ensuring accountability and adherence to donor and regulatory standards.

Statement of Revenues, Expenditures, and Changes in Fund Balances

The statement of revenues, expenditures, and changes in fund balances constitutes another essential aspect of combining fund financial statements. It delivers a thorough account of the income, expenses, and fluctuations in fund balances for each fund during a designated reporting period. This statement emphasizes the financial performance of each fund, detailing how resources were generated and expended. For example, it may demonstrate how a restricted fund was allocated to a specific initiative or how an unrestricted fund was utilized for operational costs. Furthermore, this statement captures any increases or decreases in fund balances, assisting stakeholders in comprehending the financial trajectory of the organization’s endeavour’s. By presenting this information, the statement fosters transparency and supports the assessment of whether the organization is meeting its financial goals.

Reconciliation Statements

Reconciliation statements are essential in integrating fund financial statements by reconciling the variances between fund-level and entity-wide financial reporting. Fund accounting typically encompasses various funds, each with specific purposes and restrictions, which can lead to discrepancies in the financial statements of individual funds compared to the overall organization. These statements rectify such discrepancies by ensuring that all interfund transactions and balances are accurately recorded and eliminated when necessary to prevent double-counting. For instance, if one fund extends a loan to another, the reconciliation statement will ensure that this transaction is accurately reflected, thereby portraying the organization’s true financial status. Such statements are critical for delivering a transparent and comprehensive overview of the organization’s financial health, allowing stakeholders to make well-informed decisions based on reliable and consistent information.

5. Process of Combining Fund Financial Statements

The procedure for compiling combining fund financial statements encompasses several essential steps to guarantee precision and adherence to regulations:

Step 1: Identify All Funds

The initial phase in the compilation of combining fund financial statements is to recognize and enumerate all funds within the organization. These funds generally consist of general funds, special revenue funds, debt service funds, capital projects funds, and fiduciary funds. Each fund is designated for a specific purpose and may have particular restrictions or goals. For instance, general funds may be allocated for operational costs, whereas special revenue funds could be earmarked for targeted initiatives such as education or healthcare. Accurate identification is crucial to ensure that every fund is represented in the financial statements, thereby establishing a solid basis for precise reporting. This step is especially vital for entities with varied revenue sources, as it mitigates the risk of omitting any fund during the financial reporting process.

Step 2: Prepare Individual Fund Statements

After identifying all funds, the subsequent step involves the creation of comprehensive financial statements for each fund. This process entails documenting all revenues, expenditures, assets, and liabilities related to each fund throughout the reporting period. For example, if a special revenue fund receives a grant, the income from that grant would be recorded alongside any related expenses incurred during its utilization. Additionally, the fund’s assets and liabilities, such as receivables and payables, are also noted. By developing individual fund statements, organizations can ensure that the financial activities of each fund are accurately recorded and reported. This step offers stakeholders a transparent view of how resources within each fund are being managed and allocated.

Step 3: Remove Interfund Transactions

The third step entails the removal of any interfund transactions to avoid instances of double counting. Interfund transactions, which include transfers or loans between different funds, are prevalent in fund accounting; however, they should not artificially inflate the overall financial data of the organization. For instance, when one fund allocates resources to another for a designated purpose, this transaction should not be recorded as income for the receiving fund and simultaneously as an expense for the transferring fund in the consolidated financial statements. By eliminating these transactions, the financial statements can accurately represent the organization’s actual revenues and expenses, thereby providing a clear and unblemished view of its financial condition. This step is vital for preserving the integrity of the consolidated financial statements.

Step 4: Integrate Financial Data

The final step involves integrating the remaining financial data from all individual fund statements into a unified, comprehensive statement. During this integration, it is crucial to preserve the unique identity of each fund, enabling stakeholders to access specific details related to each fund as necessary. For example, the consolidated financial statement may feature distinct columns or sections for each fund, ensuring transparency while offering a complete overview of the organization’s financial status. This integration process allows stakeholders to assess the overall financial performance of the organization while still comprehending the contributions and expenditures associated with individual funds. By organizing the data in this manner, the organization guarantees that the financial statements are both thorough and accessible.

Conclusion

The preparation of combined fund financial statements is an essential component of proficient fund accounting, significantly contributing to transparency, accountability, and clarity in financial reporting. By merging various fund-specific reports into a single statement, organizations can provide a holistic view of their financial status while preserving the unique characteristics of each fund. This integration enables stakeholders to readily evaluate the overall financial well-being of the organization, as well as the specific distribution and use of resources within individual funds. Furthermore, this process ensures adherence to legal and regulatory standards, thereby building trust among donors, grantors, and other stakeholders. The combination of fund financial statements also streamlines the intricacies of fund accounting by removing interfund transactions and avoiding double counting, which enhances the precision and dependability of financial reports. Through careful preparation and commitment to best practices, organizations can leverage these statements not only to meet reporting requirements but also to bolster their financial management and facilitate informed decision-making, ultimately advancing their mission and objectives more effectively.

Reference

Financial Statement Analysis. (2022). Google Books. https://books.google.com/books?hl=en&lr=&id=2cl6EAAAQBAJ&oi=fnd&pg=PA25&dq=Fund+Financial+Statements+Consolidation:+An+Overview+of+Fund+Accounting+in+the+United+States&ots=5YKAKv5GC3&sig=qyrwlH77FVVxtlBUUET2dIlLyRk

Fundamentals of Corporate Finance. (2015). Google Books. https://books.google.com/books?hl=en&lr=&id=nss5EQAAQBAJ&oi=fnd&pg=PA2&dq=Fund+Financial+Statements+&ots=eigMaJqcyC&sig=N5cI3vC3NfMT2c8u68REqGoWc4A

Management Accounting and Financial Control. (2024). Google Books. https://books.google.com/books?hl=en&lr=&id=o3wpEQAAQBAJ&oi=fnd&pg=PP1&dq=Fund+Financial+Statements+in+USA&ots=pFUUIuyPuo&sig=Mz1MM39rUQwfsKKctPO-Y1NG34k

Revsine, L., Collins, D. W., & Johnson, W. B. (2021). Financial reporting & analysis. In thuvienso.hoasen.edu.vn. McGraw-Hill. https://thuvienso.hoasen.edu.vn/handle/123456789/12878

Sergey Krylov. (2023). Theory and Practice of Target Financial Forecasting at Company Level. Advances in Information Quality and Management, 1–34. https://doi.org/10.4018/978-1-6684-7366-5.ch060

Shaw, J. C. (1976). Criteria for Consolidation. Accounting and Business Research, 7(25), 71–78. https://doi.org/10.1080/00014788.1976.9729088