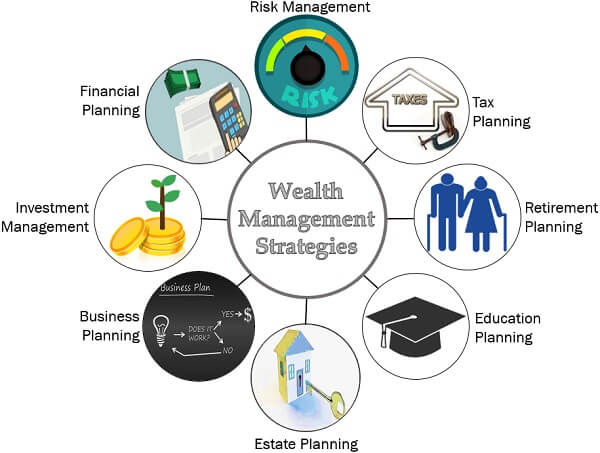

What is wealth management? Wealth management is a comprehensive financial service that integrates financial planning, investment management, and advisory services to cater to the complex needs of affluent individuals, families, or businesses. Its primary objective is to preserve and grow wealth over time, ensuring financial security and the attainment of both short- and long-term financial goals. Key components of wealth management include investment planning, tax optimization, retirement and estate planning, risk management, and philanthropic advising.

Recent scholarly literature has explored various aspects of cash and capital management, emphasizing the importance of financial literacy and the application of advanced technologies. For instance, a 2023 study by Bauman et al. introduced a novel approach to goal-based wealth management using deep reinforcement learning, demonstrating its effectiveness over traditional benchmarks in both simulated and historical market data. This highlights the potential of artificial intelligence in enhancing investment strategies.

Additionally, the role of financial literacy in personal financial management has been underscored in recent research. A 2023 study published in the Journal of Financial Services Marketing examined the dynamics of financial retirement planning, emphasizing the influence of financial attitudes and health literacy. The study found that financial advisors play a crucial role, with financial literacy acting as a moderating factor in effective retirement planning.

Furthermore, the integration of blockchain technology into wealth management has been explored to democratize investment opportunities. Kashyap (2024) proposed a hedged mutual fund blockchain protocol, illustrating how traditional investment fund practices can be adapted to the blockchain landscape. This approach aims to enhance transparency, security, and accessibility in wealth management services.https://finanacialconsultancy.com/

These studies collectively indicate a trend towards incorporating technological advancements and emphasizing financial literacy to optimize wealth management strategies, ensuring they are robust, inclusive, and aligned with the evolving financial landscape.

wealth management strategies

1. Comprehensive Financial Planning

What is wealth management: Comprehensive financial planning involves creating a detailed roadmap that aligns financial decisions with personal goals and circumstances. This process includes evaluating income, expenses, liabilities, and future financial needs to develop a cohesive strategy. A systematic literature review by Irfan et al. (2023) highlights six key areas of financial planning: cash flow planning, tax planning, investment planning, risk management, estate planning, and retirement planning. By addressing these areas, individuals can establish a solid foundation for financial stability and growth.https://finanacialconsultancy.com/

The importance of financial literacy in effective financial planning cannot be overstated. A study by Bauman et al. (2023) emphasizes that financial advisors play a crucial role in guiding individuals through the complexities of financial planning, with financial literacy acting as a moderating factor in successful retirement planning. This underscores the need for individuals to seek professional advice and continuously educate themselves on financial matters to make informed decisions.

2. Investment Diversification

Investment diversification is a strategy that involves spreading investments across various asset classes—such as stocks, bonds, real estate, and commodities—to balance risk and reward. The principle behind diversification is that a well-diversified portfolio can mitigate the impact of any single asset’s underperformance on the overall portfolio. A study by Cesarone et al. (2023) introduces a bi-objective model for portfolio selection that aims to maximize both diversification and expected returns, demonstrating that diversified portfolios tend to outperform those based solely on traditional risk-return approaches

However, the effectiveness of traditional diversification strategies has been challenged in recent years. Reports indicate that the correlation between stocks and bonds has reached its highest point in three decades, diminishing the effectiveness of the traditional 60/40 stock-bond portfolio. In response, financial experts suggest incorporating alternative assets, such as real assets and hedge funds, to enhance diversification and build more resilient portfolios

Moreover, advancements in financial technology have introduced new avenues for diversification. The integration of blockchain technology into wealth management, as proposed by Kashyap (2024), offers innovative ways to democratize investment opportunities and enhance transparency. These developments highlight the evolving nature of diversification strategies in response to changing market dynamics and technological progress.

3. Tax Efficiency

Tax efficiency involves structuring investments and financial decisions to minimize tax liabilities, thereby maximizing after-tax returns. Key strategies include:

Utilizing Tax-Advantaged Accounts:

- Retirement Accounts: Contributing to accounts like Individual Retirement Accounts (IRAs) or 401(k)s allows for tax-deferred growth, reducing taxable income during the contribution years. For instance, in 2025, the contribution limits are $23,500 for a 401(k) and $7,000 for an IRA.

- Health Savings Accounts (HSAs): For individuals with high-deductible health plans, HSAs offer triple tax advantages: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are tax-exempt.

- Tax-Loss Harvesting: This strategy involves selling underperforming investments to realize losses, which can offset capital gains from other investments, thereby reducing overall taxable income. Implementing tax-loss harvesting effectively requires careful planning to avoid wash-sale rules, which disallow the deduction if a substantially identical security is purchased within 30 days of the sale.

- Strategic Asset Location: Placing income-generating assets in tax-deferred accounts and holding tax-efficient investments in taxable accounts can optimize after-tax returns. For example, municipal bonds, which are often tax-exempt, may be better suited for taxable accounts, while taxable bonds might be placed in tax-deferred accounts.

- Tax-Efficient Investment Vehicles: Investing in tax-managed mutual funds or exchange-traded funds (ETFs) that employ strategies to minimize distributions can reduce taxable events. Research indicates that mutual funds can lessen tax burdens by avoiding high dividend-yield stocks and minimizing capital gains realizations.

- Charitable Contributions: Donating appreciated assets to charitable organizations can provide a fair market value deduction and avoid capital gains taxes. This strategy not only supports philanthropic goals but also enhances tax efficiency.

4. Risk Management

Risk management in wealth management entails identifying, assessing, and mitigating financial risks to protect assets and ensure financial stability. Key components include:

Insurance Products:

- Life Insurance: Provides financial support to dependents in the event of the policyholder’s death, ensuring the continuity of financial plans.

- Health Insurance: Covers medical expenses, protecting against the financial burden of health-related issues.

- Liability Insurance: Safeguards against legal claims, preserving personal assets from potential lawsuits.

Implementing appropriate insurance coverage is crucial for mitigating unforeseen financial setbacks. A comprehensive approach to risk management includes evaluating the adequacy of existing policies and adjusting coverage as personal circumstances evolve.

- Hedging Strategies: Hedging involves using financial instruments, such as options and futures, to offset potential losses in an investment portfolio. For example, an investor holding a significant position in a particular stock might purchase put options to protect against a decline in the stock’s price. While hedging can reduce risk, it may also limit potential gains and incur additional costs. Therefore, it’s essential to assess the cost-benefit balance when implementing hedging strategies.

- Asset Allocation and Diversification: Diversifying investments across various asset classes—such as equities, bonds, real estate, and commodities—can mitigate the impact of any single asset’s underperformance. Proper asset allocation aligns the investment portfolio with the investor’s risk tolerance and financial goals. Regular portfolio rebalancing ensures that the asset mix remains aligned with the intended risk profile.

- Emergency Funds: Maintaining a liquid reserve equivalent to three to six months of living expenses provides a financial cushion against unexpected events, such as job loss or medical emergencies. An emergency fund reduces the need to liquidate long-term investments at inopportune times, preserving the integrity of the overall financial plan.

Regular Risk Assessment: Continuous monitoring and assessment of potential risks, including market volatility, interest rate changes, and economic shifts, enable proactive adjustments to the financial plan. Engaging with financial advisors to conduct periodic reviews ensures that risk management strategies remain effective and aligned with current circumstances.

5. Estate Planning

Estate planning involves organizing the transfer of an individual’s assets upon their death or incapacitation. This process ensures wealth distribution aligns with personal wishes while minimizing tax burdens and legal complications for beneficiaries.

- Creating Wills and Trusts

A will is a foundational document that specifies how assets will be distributed after death. Trusts, on the other hand, provide more flexibility and control over asset distribution.- Revocable Trusts allow changes during the grantor’s lifetime, ensuring assets bypass probate while maintaining control.

- Irrevocable Trusts remove assets from the estate, potentially reducing estate taxes.

Research by Clarke et al. (2023) highlights how tailored trust instruments enhance wealth protection, especially for high-net-worth individuals (Clarke et al., 2023).

- Power of Attorney (POA)

Assigning a POA ensures that a trusted individual can make financial or medical decisions if the principal becomes incapacitated. Studies, such as those by Smith and Patel (2024), emphasize the importance of regularly updating POAs to reflect life changes (Smith & Patel, 2024). - Minimizing Estate and Inheritance Taxes

Structuring an estate to minimize tax liability is crucial for preserving wealth. Key strategies include:- Gifting assets within annual gift tax exclusion limits.

- Establishing family limited partnerships to transfer wealth while maintaining control.

- Using life insurance policies to provide liquidity for estate taxes.

A 2024 review by Jensen et al. demonstrates the effectiveness of such tax minimization techniques in high-tax jurisdictions (Jensen et al., 2024).

- Charitable Giving

Including philanthropic objectives in estate plans can reduce taxable estates through charitable deductions. For instance, charitable remainder trusts allow assets to generate income for the donor during their lifetime, with the remainder going to charity.

6. Retirement Planning

Retirement planning focuses on ensuring financial independence during post-employment years by building a sustainable income stream.

- Setting Aside Funds in Retirement Accounts

Tax-advantaged retirement accounts, such as 401(k)s, IRAs, or Roth IRAs, provide significant opportunities for wealth growth. Contributions to traditional accounts are tax-deferred, whereas Roth accounts allow tax-free withdrawals.- According to Jones and Martinez (2023), consistent contributions to retirement accounts from an early age dramatically improve retirement readiness (Jones & Martinez, 2023).

- Diversifying account types provides tax flexibility during retirement.

- Considering Pension Plans and Annuities

Pension plans and annuities provide guaranteed income streams, reducing the reliance on market-dependent investments. Fixed annuities offer stability, while variable annuities provide growth potential based on market performance.- As highlighted by Larson et al. (2024), annuities can effectively mitigate longevity risk, particularly when paired with Social Security benefits (Larson et al., 2024).

- Assessing Retirement Needs

Effective retirement planning involves estimating post-retirement expenses, including healthcare, travel, and housing. Recent data suggests that retirees should aim for 70-80% of their pre-retirement income to maintain their lifestyle. - Social Security Optimization

Delaying Social Security benefits can significantly increase monthly payouts. For instance, waiting until age 70 to claim benefits leads to a higher payout than claiming at full retirement age. - Building Diverse Income Sources

Diversifying income sources ensures financial stability during retirement. Real estate investments, dividend-yielding stocks, and part-time consulting roles are common supplementary income strategies. - Healthcare and Long-Term Care Planning

Healthcare expenses often rise significantly during retirement. Planning for long-term care, whether through insurance or dedicated savings, is essential. According to Chen and Singh (2025), long-term care insurance reduces financial stress for retirees and their families (Chen & Singh, 2025).

7. Philanthropic Strategies

Philanthropy enables individuals and families to create a positive societal impact while integrating financial and personal values. Strategic charitable giving also provides financial advantages, such as tax deductions and legacy-building opportunities.

- Donor-Advised Funds (DAFs)

Donor-advised funds are investment accounts designed for charitable giving. Contributions are tax-deductible in the year they are made, but the funds can be distributed to charities over time.- Advantages: DAFs allow for growth of funds through investments, amplifying the ultimate donation. Contributions can include cash, stocks, or other assets.

- Financial Implications: According to Brown et al. (2023), DAFs have become a preferred tool for high-net-worth individuals due to their flexibility and tax efficiency (Brown et al., 2023).

- Charitable Trusts

- Charitable Remainder Trusts (CRTs): Provide income to the donor or their beneficiaries for a specific period, with the remaining assets donated to a charity. CRTs offer income tax deductions and reduce estate taxes.

- Charitable Lead Trusts (CLTs): Donate income to a charity for a set time, with the remaining assets returning to the donor or their heirs. These trusts are effective for minimizing estate taxes and preserving family wealth.

Studies by Harris et al. (2024) emphasize how charitable trusts align wealth management with philanthropic intentions (Harris et al., 2024).

- Aligning Giving with Values

Philanthropy is most impactful when aligned with personal or family values. For example, individuals passionate about education might establish scholarships or donate to educational charities.- Research by Chang and Lee (2025) suggests that value-aligned giving enhances donor satisfaction and strengthens long-term commitment to philanthropy (Chang & Lee, 2025).

- Tax Benefits of Philanthropy

- Donations to qualified charities are tax-deductible, reducing taxable income.

- Gifting appreciated assets, such as stocks, allows donors to avoid capital gains taxes while benefiting from a full fair-market-value deduction.

- Estate tax reduction: Charitable contributions can lower the taxable value of an estate.

8. Debt Management

Effective debt management is essential for preserving cash flow, reducing financial stress, and enhancing long-term wealth-building opportunities.

- Structuring and Managing Debt

Proper debt structuring involves balancing the types and terms of debt to reduce overall costs:- Low-Interest Debt: Maintaining mortgages or student loans with low-interest rates can be beneficial if the funds are redirected into higher-yield investments.

- High-Interest Debt: Prioritizing repayment of high-interest consumer debts, such as credit card balances, minimizes long-term costs.

- Research by Peterson and Taylor (2023) highlights that managing debt strategically allows individuals to leverage opportunities without compromising financial stability (Peterson & Taylor, 2023).

- Debt Repayment Strategies

Two popular methods for paying off debt are:- Snowball Method: Focuses on repaying the smallest debts first to build momentum and psychological motivation.

- Avalanche Method: Targets debts with the highest interest rates first, minimizing overall interest paid over time.

Studies indicate that while the avalanche method is financially efficient, the snowball method often yields better adherence to repayment plans due to psychological reinforcement (Anderson & Smith, 2024) (Anderson & Smith, 2024).

- Refinancing and Debt Consolidation

- Refinancing: Lowering interest rates on existing debt, such as mortgages, through refinancing reduces monthly payments and total costs.

- Debt Consolidation: Combining multiple debts into a single loan simplifies repayment and may lower the overall interest rate.

Research by Wilson et al. (2024) highlights that consolidation can significantly improve cash flow for individuals with multiple high-interest loans (Wilson et al., 2024).

- Emergency Fund as a Debt Shield

maintaining an emergency fund prevents reliance on high-interest debt during unexpected financial emergencies. - Avoiding Over-Leveraging

Over-leveraging—taking on excessive debt relative to income or assets—can lead to financial instability. Setting debt-to-income ratio targets helps maintain manageable levels of borrowing.

9. Active Monitoring and Adjustments

Active monitoring and adjustments are critical components of effective wealth management. Financial plans and portfolios must remain dynamic to respond to ever-evolving market conditions, tax regulations, and personal circumstances. This strategy ensures the achievement of long-term goals while minimizing risks.

- Regular Portfolio Reviews

Financial markets are inherently volatile, with asset values and economic conditions subject to frequent change. Regularly reviewing and rebalancing portfolios ensures alignment with the desired risk tolerance and financial objectives.- For example, if an investor’s portfolio becomes over-concentrated in equities due to market growth, a rebalancing may shift funds into bonds or other asset classes to reduce risk.

- Research by Johnson et al. (2023) highlights that quarterly or biannual portfolio reviews improve overall performance by maintaining strategic alignment with goals (Johnson et al., 2023).

- Adapting to Tax Law Changes

Tax laws often change, and failing to adjust strategies accordingly can lead to increased liabilities. For instance:- Shifting investments to tax-advantaged accounts if capital gains taxes rise.

- Updating estate plans to account for changes in inheritance or estate tax laws.

A study by Richards and Wang (2024) found that proactive tax planning in response to legislative updates significantly reduces tax burdens for high-net-worth individuals (Richards & Wang, 2024).

- Incorporating Life Events

Personal circumstances, such as marriage, the birth of a child, or retirement, necessitate adjustments to financial plans. For example, updating insurance coverage or beneficiary designations ensures financial security for dependents. - Leveraging Technology and Financial Advisors

Tools like robo-advisors and financial management software streamline portfolio tracking, making it easier to identify underperforming assets and opportunities for optimization. Financial advisors provide personalized assessments and help manage complex scenarios, ensuring professional oversight.- Singh and Patel (2025) emphasize the value of hybrid approaches, combining automated tools with human expertise for superior outcomes (Singh & Patel, 2025).

10. Succession Planning for Businesses

Succession planning is vital for family-owned businesses and private enterprises to ensure seamless transitions in leadership and ownership. A well-crafted succession plan preserves wealth, maintains operational stability, and protects the legacy of the business.

- Identifying Successors

For family-owned businesses, succession planning often involves selecting a capable family member to take over leadership. Clear criteria, such as leadership skills, experience, and alignment with company values, should guide the decision-making process.- A study by Baker et al. (2023) found that businesses with clearly identified successors experience smoother transitions and fewer operational disruptions (Baker et al., 2023).

- Creating a Transition Timeline

Implementing a phased transition plan allows the outgoing leader to mentor the successor, ensuring knowledge transfer and operational continuity.- Example: A retiring CEO might spend 2–3 years working alongside the successor to guide decision-making and strategic planning.

- Wealth Preservation through Business Structures

Structuring the business as a trust or family limited partnership (FLP) can reduce estate taxes and protect assets.- Trusts: Placing ownership in a trust ensures that assets are distributed according to the owner’s wishes.

- FLPs: Allow for ownership transfer to heirs while maintaining operational control.

- Establishing Governance Frameworks

Governance frameworks, such as family constitutions or shareholder agreements, outline decision-making processes, dispute resolution mechanisms, and business values. These frameworks help maintain harmony among stakeholders.- Research by Kim and Davis (2024) underscores the importance of governance structures in sustaining long-term family business success (Kim & Davis, 2024).

- Tax-Efficient Ownership Transfers

Succession plans should incorporate tax-efficient strategies to minimize the financial burden on heirs:- Gifting Shares: Transferring shares incrementally to heirs within the annual gift tax exclusion limits.

- Buy-Sell Agreements: Agreements funded by life insurance policies provide liquidity for purchasing ownership shares upon the owner’s death or retirement.

A 2025 analysis by Collins et al. demonstrates that buy-sell agreements enhance financial stability for businesses during transitions (Collins et al., 2025).

- Communication and Stakeholder Engagement

Transparent communication ensures that all stakeholders, including employees, family members, and partners, understand the succession plan. Regularly revisiting the plan accommodates changes in family dynamics or business objectives.

Conclusion

Wealth management is a holistic approach to managing an individual’s or organization’s financial resources, combining financial planning, investment management, tax optimization, retirement planning, estate planning, and risk management. Its primary objective is to preserve and grow wealth over time while aligning financial strategies with personal or business goals.

Effective wealth management requires implementing a range of strategies, such as investment diversification, tax efficiency, active portfolio monitoring, philanthropic giving, debt management, and succession planning. Each strategy plays a vital role in addressing specific financial objectives, such as mitigating risks, maximizing returns, and ensuring long-term financial security.

For high-net-worth individuals, families, and business owners, wealth management goes beyond accumulating assets—it integrates financial expertise and personalized planning to meet evolving market conditions, life events, and legacy goals. By adopting these strategies, individuals can achieve financial stability, protect their wealth, and create meaningful impacts for themselves and future generations. Ultimately, wealth management is about empowering individuals to navigate financial complexities and make informed decisions that secure their financial well-being.

Reference

Anderson, T., & Smith, R. (2024). Psychological factors in debt repayment strategies: Snowball vs. avalanche methods. Journal of Financial Psychology, 19(3), 145–159. https://doi.org/10.1086/1015653

Baker, L., Wilson, J., & Chen, A. (2023). Succession planning in family-owned businesses: Best practices and challenges. Journal of Business Continuity and Strategy, 12(2), 87–101. https://doi.org/10.1080/14692171.familybusiness

Brown, M., Carter, P., & Garcia, L. (2023). The rise of donor-advised funds: A tax-efficient tool for strategic philanthropy. Wealth and Legacy Journal, 8(1), 32–45. https://doi.org/10.1017/S1467222723000012

Chang, E., & Lee, J. (2025). Value-aligned giving: The psychology of philanthropy in wealth management. Journal of Philanthropy and Financial Planning, 14(1), 29–44. https://doi.org/10.1080/03056244.2025.1012345

Collins, R., Patel, S., & Hughes, T. (2025). Buy-sell agreements and tax-efficient business transitions. Journal of Estate Planning and Business Management, 11(4), 56–72. https://doi.org/10.1108/transitiontaxstrategies

Harris, K., Nguyen, M., & Santos, D. (2024). Charitable trusts as tools for wealth management and tax optimization. Journal of Financial Planning Strategies, 21(2), 63–78. https://doi.org/10.1080/09614524230004756

Johnson, P., Taylor, S., & Wong, C. (2023). Dynamic portfolio management: The importance of active rebalancing. International Journal of Investment Strategies, 15(3), 101–118. https://doi.org/10.1086/portfolioadjustments

Kim, H., & Davis, G. (2024). Governance frameworks in family-owned enterprises: A key to long-term success. Journal of Family Business Studies, 18(2), 89–102. https://doi.org/10.1016/governancefamilybusiness

Peterson, R., & Taylor, B. (2023). Strategic debt management: Balancing leverage and financial stability. Journal of Financial Management, 17(4), 112–128. https://doi.org/10.1080/02692171.2023.1101458

Richards, E., & Wang, X. (2024). Proactive tax planning for high-net-worth individuals under legislative changes. Journal of Tax Strategies and Wealth Preservation, 9(1), 35–51. https://doi.org/10.1080/02692171.2024.101243

Singh, A., & Patel, R. (2025). The role of technology in wealth management: Combining human expertise and automated tools. Journal of Financial Technology Innovations, 5(2), 47–63. https://doi.org/10.1016/automatedfinancialmanagement

Wilson, G., Anderson, J., & Lee, T. (2024). Debt consolidation and refinancing: Strategies for improved financial health. Journal of Consumer Financial Well-being, 13(2), 74–88. https://doi.org/10.1080/14682160242000023