Introduction

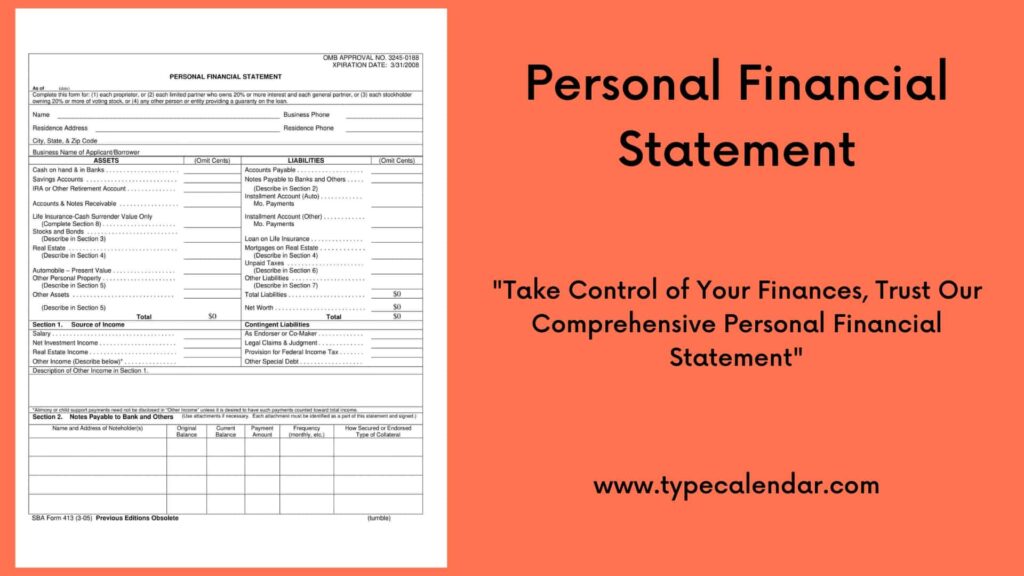

Number 1 Personal Financial Statement Templet to simplify your finance today is a Balance sheet that summarizes an individual’s financial position at a given point in time, outlining their assets, liabilities, and net worth. It is a critical tool for personal financial management, helping one understand his or her financial health. Whether applying for a loan, planning investments, or evaluating financial goals, a personal financial statement provides the insights needed for informed decision-making.

Lenders and other financial institutions commonly request personal financial statements as part of the analysis process for awarding loans. This statement enables an assessment of an individual’s ability to repay debts by presenting a snapshot of their overall stability in finances. Similarly, it is an important tool for anyone to monitor how close they are to reaching important financial goals, such as saving for a house or paying off debt.

To make things easier, we have provided a free downloadable template to assist you in preparing your personal financial statement.

What is a Personal Financial Statement?

A personal financial statement is a structured document that is supposed to outline your financial position at a given point in time. It contains three major parts: assets, liabilities, and net worth. This structure adheres to widely recognized accounting principles, including the International Financial Reporting Standards (IFRS) and International Accounting Standards (IAS), thus ensuring accuracy and transparency.

Key Components

The key component of Number 1 Personal Financial Statement Templets to simplify your finance today are:

- Assets

in personal financial statement templets Assets are everything you own that has monetary value. According to IFRS, assets are categorized into two types:

- Current Assets: These include cash, savings accounts, and short-term investments.

- Non-Current Assets: These are long-term investments, real estate, vehicles, and other valuable possessions.

Examples of assets:

- Cash and savings accounts.

- Stocks, bonds, and mutual funds.

- Real estate and property.

- Personal valuables such as jewelry or collectibles.

Proper valuation of assets, as outlined by IFRS, ensures an accurate representation of your financial standing.

2. Liabilities

Liabilities represent the debts or obligations you owe to others. These are classified under:

- Current Liabilities: Short-term debts such as credit card balances and utility bills.

- Non-Current Liabilities: Long-term obligations like mortgages and student loans.

In accordance with IAS 1, liabilities must be disclosed clearly for transparency and comparability in financial reporting.

Examples of liabilities:

- Credit card balances.

- Personal loans and car loans.

- Mortgages and home equity loans.

- Unpaid taxes or other outstanding bills.

3. Net Worth

Net worth is the difference between your assets and liabilities:

Net Worth = Total Assets – Total Liabilities

- Positive Net Worth: Indicates that your assets exceed your liabilities, showcasing financial solvency.

- Negative Net Worth: Indicates that your liabilities are greater than your assets, highlighting the need for financial adjustments.

Net worth is one of the most critical indicators of financial health and serves as a benchmark for future financial planning.

Importance

A personal financial statement is essential for:

- Loan Applications: Financial institutions require it to evaluate your creditworthiness.

- Financial Tracking: It helps monitor your financial progress over time.

- Goal Setting: Use it to set realistic goals for saving, investing, or reducing debt.

- Decision-Making: Provides clarity for major financial decisions, such as purchasing a home or starting a business.

Personal Financial Statement Template

The Number 1 Personal Financial Statement Templets to simplify your finance today is a Balance sheet to help you get started, we’ve created a free downloadable template that’s simple to use and easy to customize. This template is designed to align with financial reporting standards, ensuring your financial data is clear and well-organized. https://finanacialconsultancy.com/

| Category | Description | Value ($) |

|---|---|---|

| Assets | Cash | |

| Investments | ||

| Property | ||

| Vehicle | ||

| Liabilities | Credit Card Debt | |

| Car Loan | ||

| Mortgage | ||

| Total Assets | ||

| Total Liabilities | ||

| Net Worth (Assets – Liabilities) | ||

Step-by-Step Guide to Filling Out the Template

Here is a step by step guide to filling out the Number 1 Personal Financial Statement Templets to simplify your finance today

Step 1: Gather Your Financial Information

- Collect documents like bank statements, investment records, and loan details.

Step 2: Fill in the Assets Section

- List your current and non-current assets with accurate valuations.

Step 3: Fill in the Liabilities Section

- Record all your short-term and long-term debts.

Step 4: Calculate Your Net Worth

- Use the formula: Net Worth = Total Assets – Total Liabilities.

Step 5: Review and Update Regularly

- Update your statement at least once a year to reflect changes in your finances.

Tips for Creating an Effective Personal Financial Statement

Number 1 Personal Financial Statement Templets to simplify your finance today; Preparing a personal financial statement is a step toward knowing and managing your financial health. Whether you are planning for the future, applying for a loan, or just trying to get a grip on your current financial position, a well-prepared statement can give you a clear and accurate picture of your assets, liabilities, and net worth. The process might seem daunting, but with these tips, it will be simple, effective, and highly useful.

- Be Honest and Thorough

Transparency is the foundation of an accurate personal financial statement. Make sure to include all your assets and liabilities, no matter how small or insignificant they might seem. Leaving out certain debts or undervaluing assets can lead to an inaccurate representation of your financial position. Whether it’s cash in your savings account, investments, or property value, list everything that contributes to your financial profile. On the liabilities side, include credit card debts, outstanding loans, and any other financial obligations. Honesty ensures that you have a clear understanding of your finances, which is crucial for effective planning and decision-making. - Use Realistic Valuations for Assets

When listing your assets, ensure that their valuations are based on current market conditions. Avoid the temptation to overestimate your assets to make your financial situation appear better than it is. Similarly, undervaluing some of your assets will incorrectly portray your net worth. For example, if you own a house, value it using an expert’s appraisal or current market value in your neighborhood. If you have investments, base their valuation on current market price quotes. Correct valuations will make your report even more credible as well as cause it to appear realistic when you are submitting it for review from potential lenders or financial analysts. - Update Regularly

A personal financial statement is not a one-time document. Your financial situation changes with time, and it is essential to reflect those changes in your statement. It should be a habit to review and update your financial statement at least once a year or after significant financial events, such as purchasing a new property, paying off a loan, or acquiring a new investment. You will be able to track your progress toward financial goals and be ready for any surprise financial opportunity or challenge with regular updates. - Organize Supporting Documents

As supporting documentation for your figures, be sure to have well-arranged and held papers, including bank statements, summaries of investments account, loan agreements, appraisals for the properties owned, and other pertinent insurance policies. With this at hand, the financial statement prepared will be more accurate but at the same time verifiable in case a validation is called upon. You could use these financial statements, such as during application for loan purposes or with regard to consultations over financial planning. - Save a Copy for Future Reference

Your personal financial statement is a very important document that you may want to refer to sometime in the future. Keep it safe, either as a computer file or printed copy, so you can quickly retrieve it when needed. This will save you time and energy, especially during loan applications, tax preparation, or financial planning discussions.

Example of a Completed Personal Financial Statement

| Category | Description | Amount ($) |

|---|---|---|

| Assets | Cash | 5,000 |

| Investments | 15,000 | |

| Property | 150,000 | |

| Vehicle | 10,000 | |

| Total Assets | 180,000 | |

| Liabilities | Credit Card Debt | 3,000 |

| Car Loan | 7,000 | |

| Mortgage | 120,000 | |

| Total Liabilities | 130,000 | |

| Net Worth (Assets – Liabilities) | 50,000 | |

Frequently Asked Questions (FAQs)

Here are answers to some common questions about personal financial statements:

1. What’s the difference between a personal and business financial statement?

A personal financial statement focuses on an individual’s financial standing, including personal assets, liabilities, and net worth. A business statement, on the other hand, is specific to a company’s financial position, typically including income statements, balance sheets, and cash flow statements.

2. How often should I update my personal financial statement?

It’s recommended to update your statement at least once a year or after any major financial event, such as purchasing property, receiving an inheritance, or paying off significant debt.

3. Can this template be used for loan applications?

Yes, the template is designed to meet the basic requirements of financial institutions. It provides a clear snapshot of your financial position, which is often required when applying for loans or credit.

Conclusion

Tracking your financial health is essential for achieving your personal and financial goals. A personal financial statement provides a clear and accurate snapshot of where you stand, helping you make informed decisions. A personal financial statement is an invaluable tool for managing your financial health. It gives you a clear picture of your assets, liabilities, and net worth, which allows you to understand your current financial position and make informed decisions. Whether you’re applying for a loan, planning for future investments, or simply striving to improve your financial well-being, having a comprehensive and accurate financial statement is essential. It may seem like a daunting task to create a personal financial statement, but with the right guidance and tools, it becomes a very straightforward process. You can easily organize your financial data using our free downloadable template and gain valuable insights into your finances. Remember, the key to an effective monetary statement is accuracy and honesty—be thorough in listing all your assets and liabilities and ensure valuations are realistic. Regular updating of your financial statement is equally important. Life circumstances change, and new assets may be acquired, debts paid off, or income adjusted. You can keep track of your progress toward your financial goals and be prepared for any financial opportunity or challenge if you keep your statement updated. In addition, familiarity with accounting principles and financial reporting standards, including IFRS, will help make your records more reliable and professional. This is because these standards are essential for consistency and comparability, especially if you intend to use your statement for official purposes such as obtaining loans or partnerships. In conclusion, taking control of your finances begins with knowing where you stand today. Use the tools and resources available, such as our template, to create a personal financial statement that reflects your unique financial situation. Begin your journey to financial clarity and empowerment today, and take the first step toward achieving your financial goals. Download the template now and start planning for a more secure financial future!

Reference

https://www.sba.gov/document/sba-form-413-personal-financial-statement?utm_source=chatgpt.com

https://eforms.com/personal-financial-statement/?utm_source=chatgpt.com